Marketing material from major financial firms is always quick to highlight the benefits of tax-deferral, sometimes simply called tax-deferred growth. 401(k)s, 403(b)s, traditional Individual Retirement Accounts (IRAs), and some other tax-qualified plans have this characteristic.

Giving some additional thought to the claims of marketers is usually worthwhile. That goes double when the source of this marketing language is (ultimately) the government! Bear in mind, tax-qualified plans are “loopholes” created to help people cope with the problems the government is responsible for in the first place.

Let us consider the common question, “Should I invest in a traditional IRA or Roth IRA?”

Traditional IRA or Roth IRA?

Because we are going to look at this logically, we will first look only at the primary distinction between the assets: When you pay your income taxes. Let us pretend, furthermore, that there are no additional fees for buying in, selling out, ongoing management, or accessing the funds “early.” It is certainly possible to do a more thorough analysis and introduce other considerations. That is not the point of this article. The goal here is to isolate the question of tax deferral.

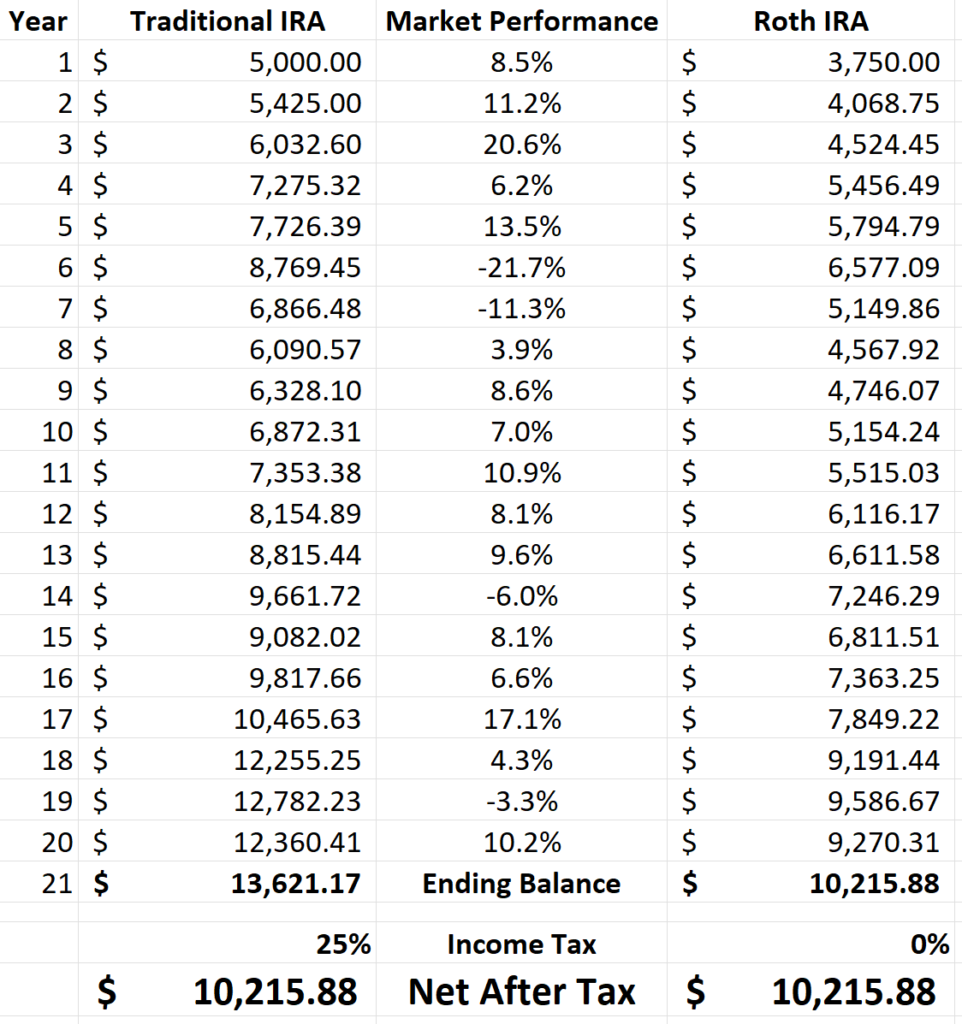

Our hypothetical human—let’s call him Frank—puts $5,000 each in a traditional IRA and a Roth IRA. For simplicity, we will say that this is a one-time investment. We will also assume that he knows with crystal-ball certainty what the tax rate will be when he tax the funds back out: 25%.

In the traditional IRA, Frank has the “benefits of tax deferral,” so his $5,000 goes in and gets invested in mutual funds. In the Roth IRA, Frank takes the 25% tax hit up front, so $3,750 gets invested in the exact same mutual funds in the exact same proportions.

Let’s make up some stock market numbers for 20 years and see what happens:

Frank feels good about his investments, but notices that across the 20 years he always has more money in the traditional IRA. It feels better to see the bigger number in that account.

Let’s look at the last 3 rows. The traditional IRA seems to be the clear victor here. The balance is $3,405.29 higher than in the Roth IRA! Benefits of tax deferral indeed!

Ah, but Frank hasn’t paid his income tax yet! His impressive $13,621.17 drops by 25% at withdrawal and becomes $10,215.88—exactly the same as the value of the Roth IRA!

Change the mutual fund performance to anything you want. Change the tax rate to anything you want. Both vehicles will get the same number at the end.

So Which One is Better?

However, this all assumes that the tax rate is the same at the beginning and end of this time period. Is that a reasonable assumption? What do you think tax rates will do by the time you can withdraw your money from a tax-qualified plan?

- If you believe tax rates will stay the same, we have seen that tax deferral (by itself) provides no benefit over paying taxes now and generating tax-free growth afterward.

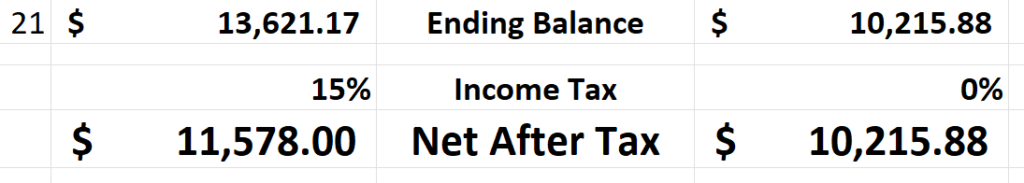

- If you believe tax rates will go down, tax deferral is valuable. Using my table, if tax rates go down to 15%, at the end we get $11,578.00 in the traditional IRA versus $10,215.88 in the Roth IRA.

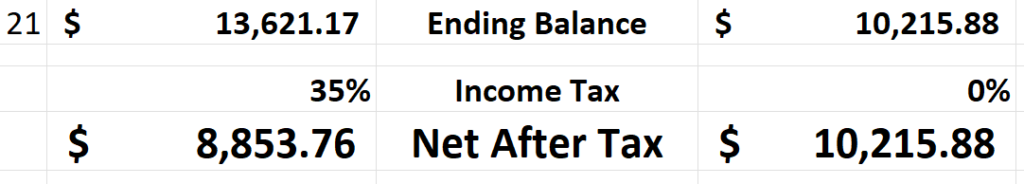

- If you believe tax rates will go up, tax deferral is a disadvantage. Using my table, an ending tax rate of 35% means we get $8,853.76 in the traditional IRA versus $10,215.88 in the Roth IRA.

Thinking about the national debt, you may feel that I am recommending everyone open a Roth IRA.

No.

Again, my primary mission here is to dispel the myth that tax deferral, by itself, is some amazing boon that we should all be clamoring for. (Not to mention, I can’t give any advice of any kind without knowing your unique circumstances.)

Rethinking the Retirement Account

In truth, I am not a fan of any of these “retirement accounts.”

As Nelson Nash says in his incredible book, Becoming Your Own Banker:

“When the government creates a problem (read: onerous taxation) and then turns around and creates an exception to the problem they created (read: tax sheltered retirement plans, etc.) aren’t you just a little bit suspicious that you are being manipulated?”

To go one step further, the cynic in me has noticed an interesting trend: Nearly all “financial advisors” give the same advice: “Participate in your tax-deferred retirement plans to the fullest extent possible!” Sometimes this is phrased simply as “Take the free money!” (in reference to a matching contribution from the employer.)

While the subject of “taking the free money” is a bit too complex for this article, as we have seen, these plans look better for years. That is, until it’s time to pay taxes. (If you want a deep dive into the “free money” issue, try Andy Tanner’s book, 401(k)aos.)

Well, guess what? The financial industry gets paid on the current balance, regardless of tax status!

Yes, there is a very real financial incentive to keep the “on-paper” number higher. In other words, do you think the advisor would rather get paid a commission or a management fee on the tax-deferred balance, or the after-tax balance? Who is getting the “benefits” part of the “benefits of tax deferral?“

If there is a large sum being discussed—say, $1,000,000—taxed at the top rate for 2022. That’s asking someone to choose a payday derived from $1,000,000 or a payday derived from $630,000! Would you find it easy to routinely give yourself a 37% reduction in earnings?

(Remember! The financial advisor the owes his own income tax on his earnings, as well!)

You Have Other Options

Am I saying the entire industry is predatory and only out to make as much money as possible? No.

What I am saying is that a conflict of interest does exist, and the industry tends to get caught up in the newest, shiniest tools cooked up by product designers and regulators. Meanwhile, they completely gloss over (or, more likely, don’t understand) the power of building your own banking system using a vehicle that has existed for much longer than the income tax: dividend-paying whole life insurance from a mutual insurance company.

This strategy, done correctly:

- Grows tax-free like a Roth IRA.

- Can never decrease in value.

- Is not subject to the swings of the stock market.

- Allows you to access the money before the government-decreed “retirement age.”

- Reduces (or eliminates!) your need for outside lenders, such as banks, auto finance companies, etc.

- Gets more efficient every single year.

- Provides a death benefit to your beneficiaries (that also grows every year!) in case something happens to you.

You can still invest in the stock market if you want to do that, but why not build an appropriate place to store your wealth first? When you are ready to learn more, I am here to help!